How do you service Starbucks and mom and pop on the same tax platform?

What I Did :

Product Requirements, Information Architecture, Interaction Design

Problem:

Tax Credit Co. is a company that uses special software to help businesses keep track of employees that are eligible for federal tax credits when employers hire Veterans, Native Americans or those in a Special Program. The company makes its money by using technology to keep track of those credits, processing them, and charging clients a portion of the savings.

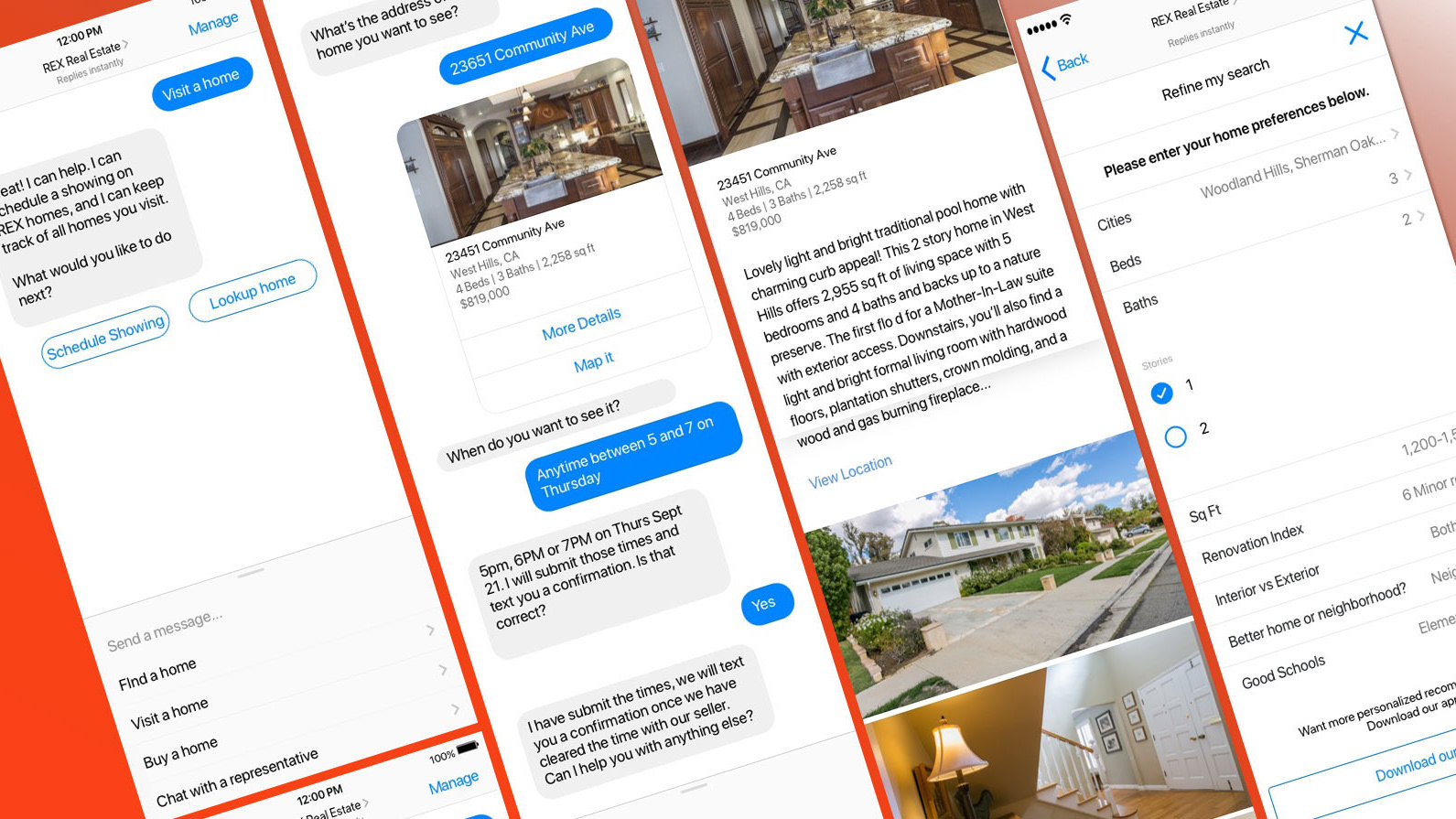

The previous platform was very old and hard to use. In an effort to make the platform self service and easy to use to help customer service, but also to help customers manage their own credits at some point.

The biggest challenge was the variety of use cases that needed accommodation. The company serviced small business customers to large corporations— which have complex corporate structures— and everything in-between. This required flexibility, however, we could not make things so flexible that it hampers usability for basic tasks, which is often the case with Enterprise software.

Process flow for how an applicant qualifies

Because of the different types of entities and structures, we needed to visualize the core structure of how companies were set up and the relationships between entities and employees.

Analysis:

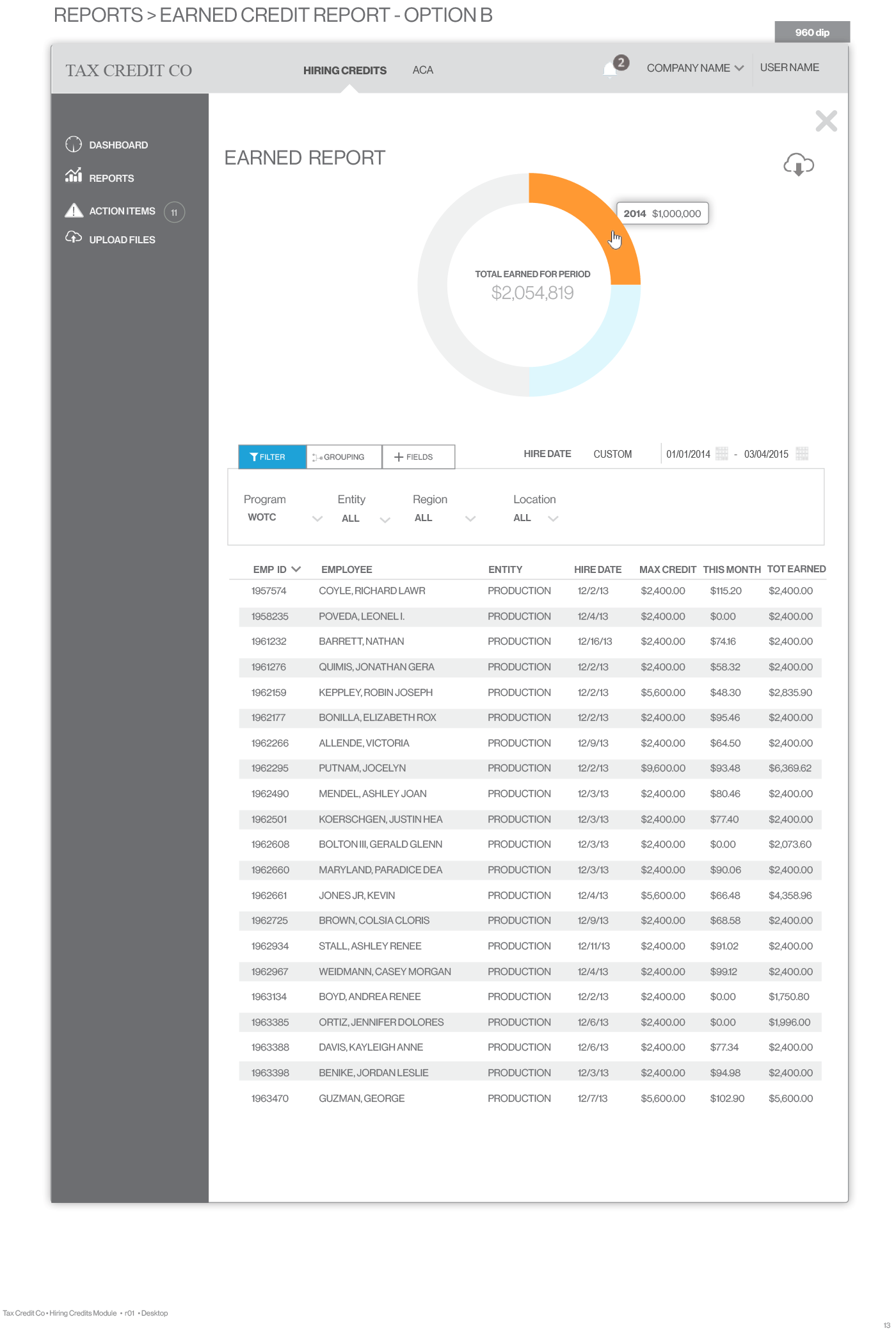

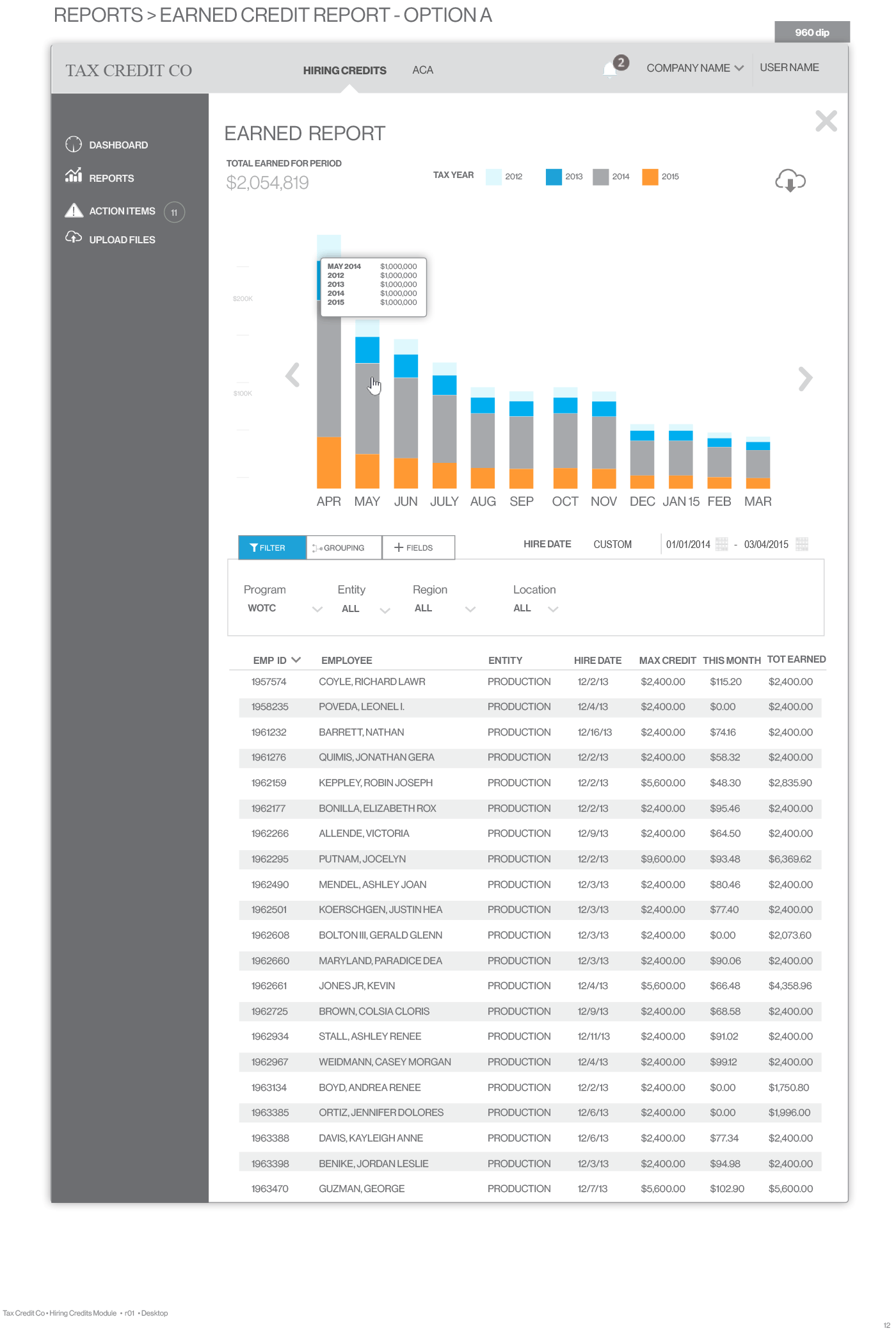

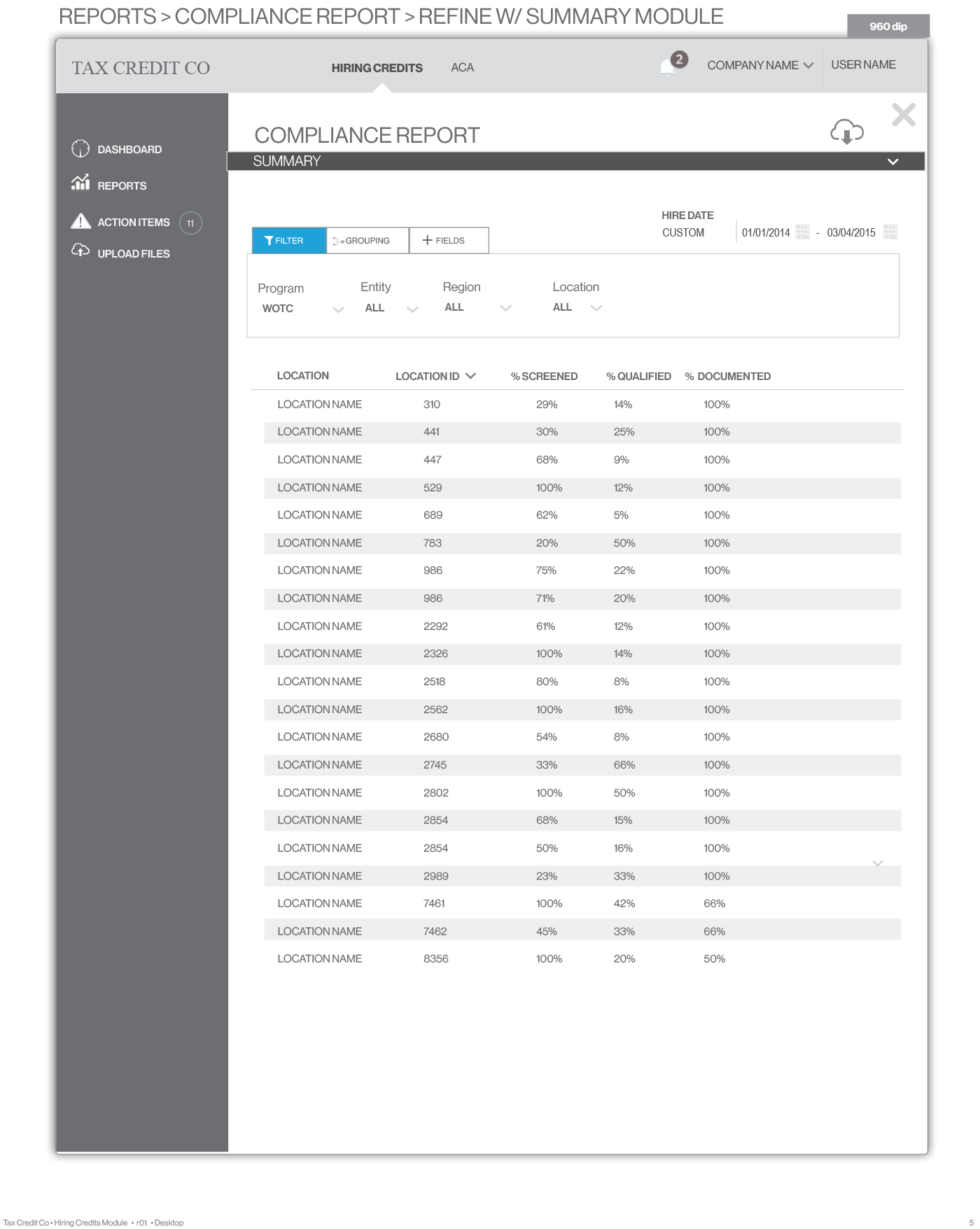

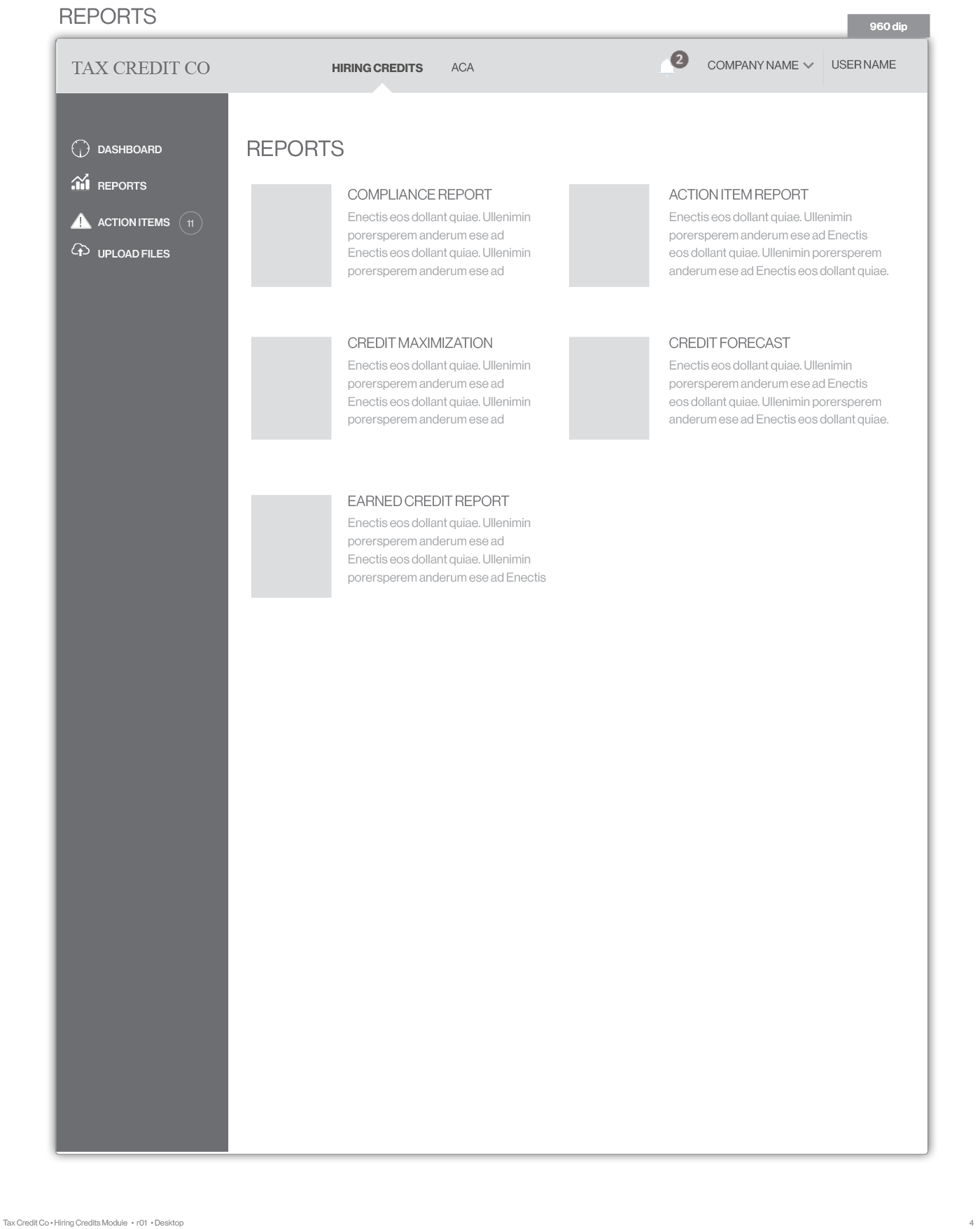

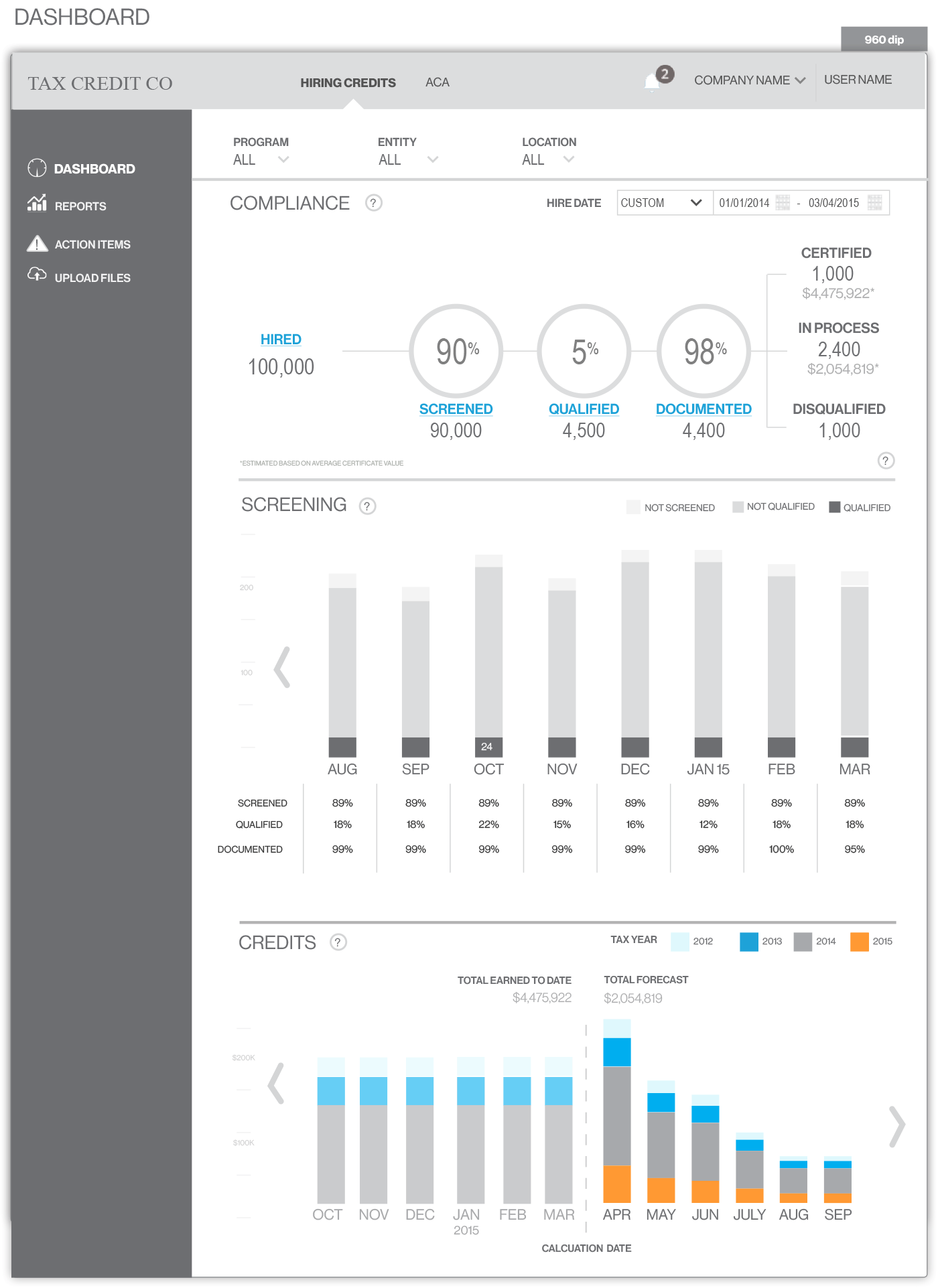

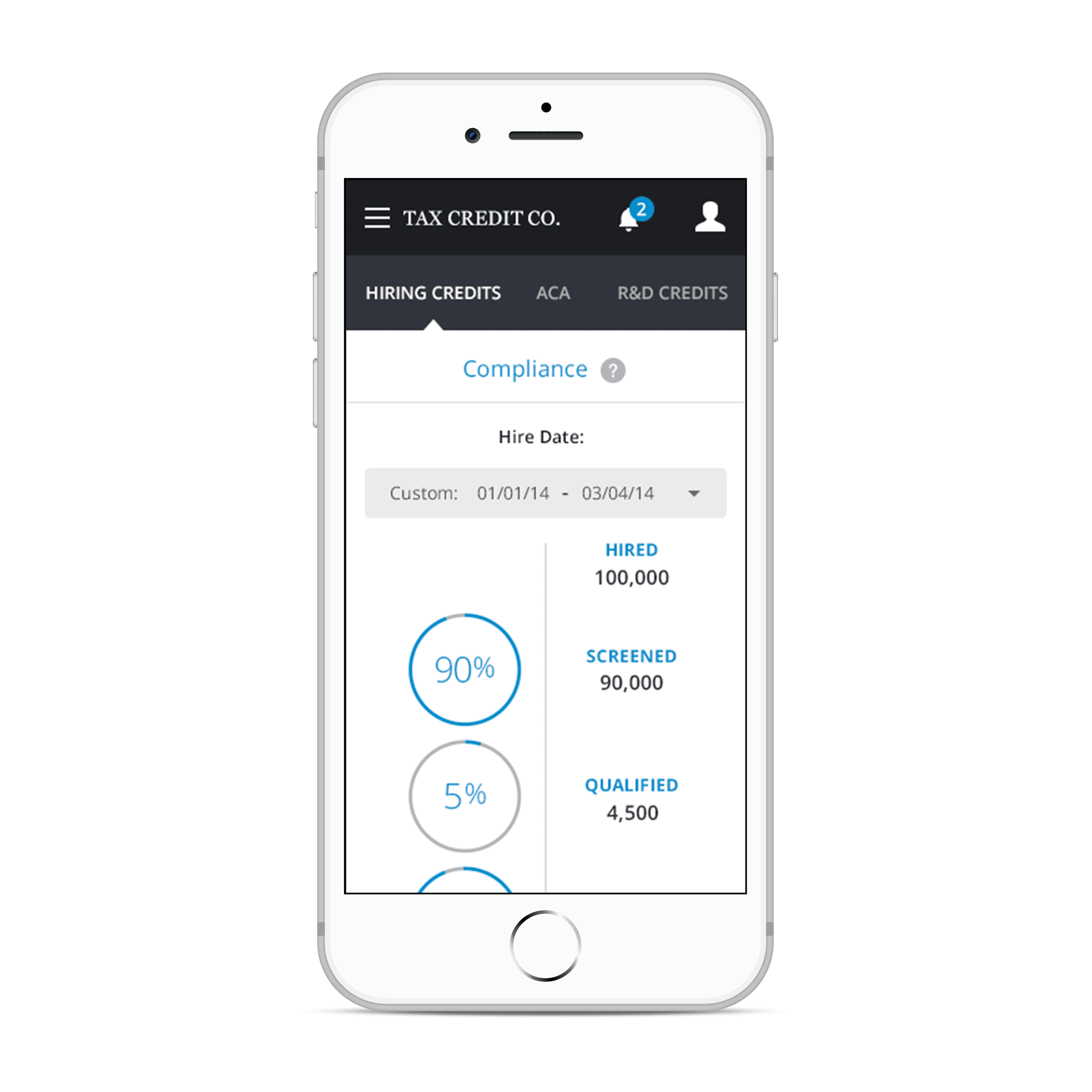

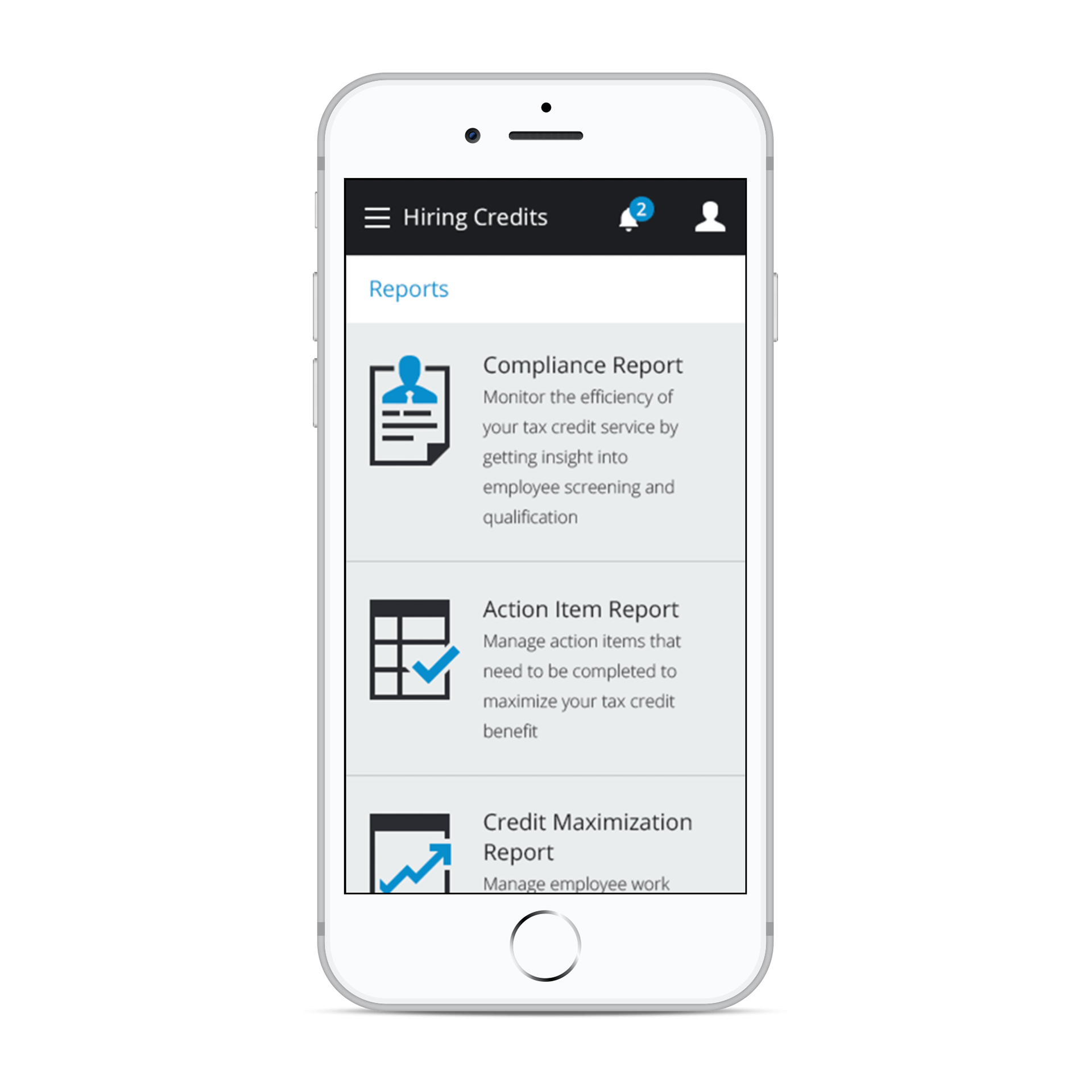

One of the big problems was getting administrators to see how much they are missing from non-compliance. The dashboard and digital reports offer a glimpse into their effectiveness and their funnel. We also incorporated notifications and action items to help administrators be more on top of expiring credits. As we grew, the data science team was able to predict approximately what they would make in the future from credits.

Another of the major challenges was the different corporate structures. Large corporations such as Starbucks and Chipotle (both of whom use the platform), had complex corporate structures with nested entities, multiple locations and complex assignments of credits. The typical small business had one corporation with all employees under one entity. We would up having to nest organizations and create business rules and service design around how those got processed.

Solution :

The final solution accommodates the Work Opportunity Tax Credits and allows administrators to send a snapshot of this to their customers to see how much value the company is providing.